Get A Second Chance With An Auto Title Loan From VIP Finance

Blog

Introduction

Welcome to Title Loans McAllen, your trusted source for financial solutions. If you're looking for a second chance to secure a loan, you've come to the right place. At VIP Finance, we specialize in auto title loans, providing individuals with the opportunity to access the funds they need, regardless of their credit history. Say goodbye to long approval processes and tedious paperwork – with our efficient and hassle-free loan process, you can get back on track financially in no time.

Why Choose VIP Finance?

When it comes to finding the right lender for your financial needs, it's essential to pick one that understands your unique circumstances and provides the best solutions. Here's why VIP Finance is your preferred choice:

- Flexible Eligibility Requirements: We believe that everyone deserves a fair chance, regardless of their credit score or financial background. That's why our loan approval is solely based on the value of your vehicle and your ability to repay the loan.

- Quick and Convenient Process: We understand that emergencies can arise at any time. With VIP Finance, you can expect a speedy approval process, ensuring that you get the funds you need when you need them the most.

- Competitive Interest Rates: We strive to provide our customers with affordable loan options. Our competitive interest rates enable you to comfortably repay the loan while meeting your other financial obligations.

- Professional and Friendly Service: At VIP Finance, we take pride in delivering exceptional customer service. Our team of experts is here to address your concerns, guide you through the loan process, and ensure that you feel supported every step of the way.

How Does an Auto Title Loan Work?

Now that you know why VIP Finance is the ideal choice for your financial needs, let's explore how an auto title loan actually works:

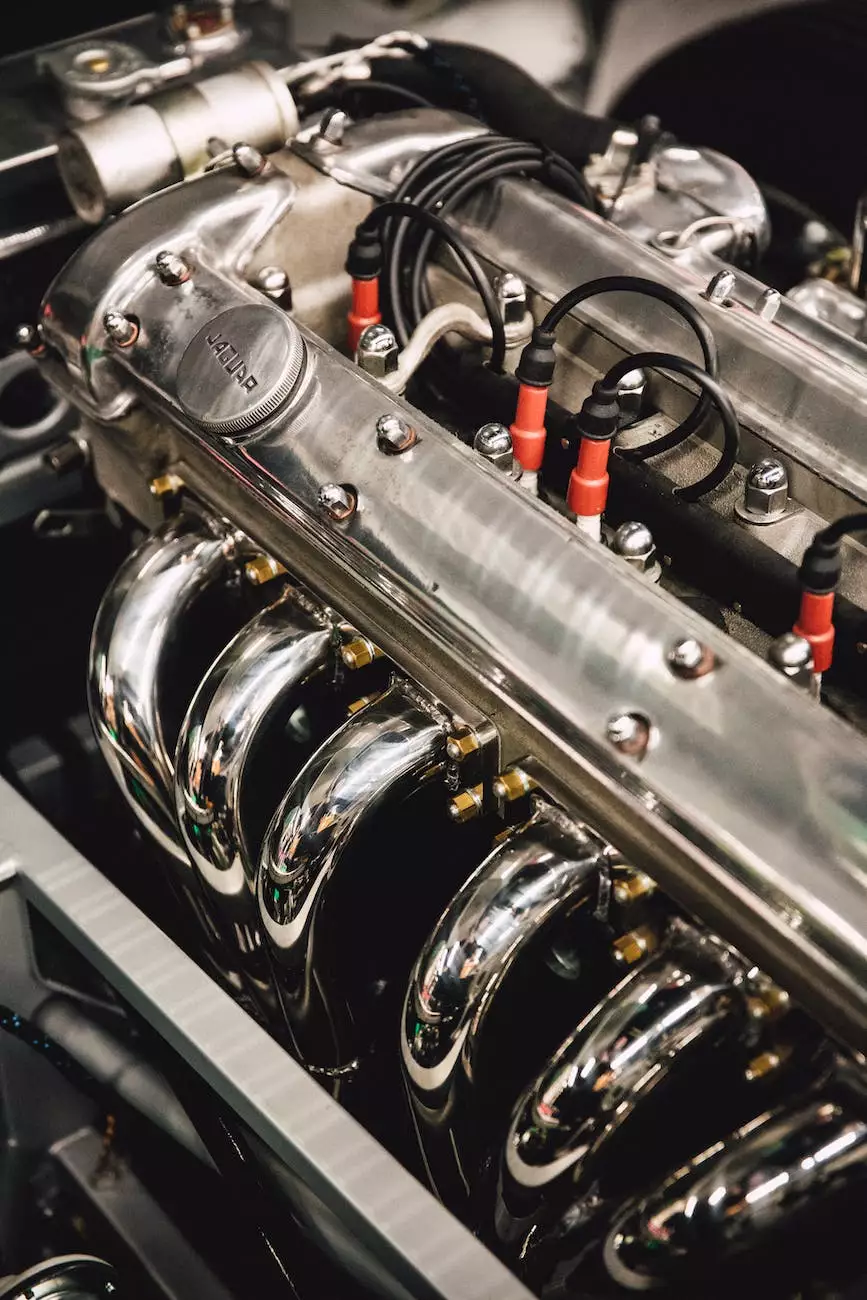

An auto title loan is a secured loan that allows you to borrow money using your vehicle's title as collateral. The loan amount is determined by the value of your vehicle, and you temporarily transfer the title to the lender in exchange for the funds. However, you can continue using your vehicle during the loan term as long as you make timely repayments.

At VIP Finance, we have streamlined the loan process to make it as simple and efficient as possible. Here's a step-by-step guide:

- Application: Start by filling out our easy online application form or visit our nearest branch to apply in person. Provide us with accurate information about yourself and your vehicle.

- Vehicle Evaluation: Our experts will conduct a quick evaluation of your vehicle to determine its value. This evaluation is carried out to ensure that your loan amount accurately reflects the worth of your vehicle.

- Loan Approval: Once your application is reviewed and your vehicle's value is assessed, our team will notify you about the loan approval. You can expect a speedy approval process, bypassing the lengthy credit checks typically associated with traditional loans.

- Signing the Agreement: Collaborate with our knowledgeable loan officers to review and sign the loan agreement. Ensure that you understand all the terms and conditions before proceeding.

- Receiving Funds: Once the agreement is signed, you'll receive your loan funds either through direct deposit, check, or in-person cash pickup according to your preference.

- Loan Repayment: Make timely monthly payments according to the agreed terms and conditions. Our flexible repayment options allow you to choose a plan that suits your financial situation.

- Loan Closure: Once the loan is fully repaid, including any applicable fees and interest, your vehicle's title will be promptly returned to you.

Benefits of an Auto Title Loan from VIP Finance

Now that you understand the process, let's delve into the benefits of choosing an auto title loan from VIP Finance:

- Easy Approval: Unlike traditional loans, which heavily weigh credit history, auto title loans consider the value of your vehicle and your ability to repay the loan as the primary factors for approval. This means that even if you have poor credit or a limited credit history, you can still secure a loan with us.

- Accessible Funds: With VIP Finance, you can access the funds you need quickly. Our streamlined approval process ensures you get the funds in a timely manner, allowing you to address your financial needs promptly.

- No Driving Restrictions: We understand how important it is for you to continue using your vehicle. With an auto title loan from VIP Finance, you can keep your car and use it as usual during the loan term, as long as your repayments are made on time.

- Flexible Repayment Options: We work closely with our customers to design repayment plans tailored to their specific financial situations. Our flexible options enable you to repay the loan comfortably without causing additional stress on your budget.

Conclusion

When life throws unexpected financial challenges your way, don't lose hope. VIP Finance is here to provide you with a second chance through our auto title loan options. With our flexible eligibility requirements, quick approval process, and competitive interest rates, securing the funds you need has never been easier. Count on Title Loans McAllen and let us help you get back on track financially. Apply now and experience the VIP Finance difference.